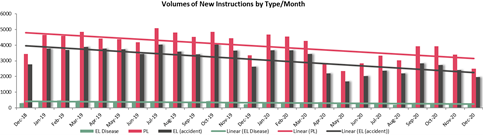

The figures from the Claims Portal Company to December 2020 shows a continuing decline in claim volumes. As the chart below shows, the downward trend has continued over the last two years. We can see the immediate drop in new instructions in April and May 2020 on the back of the COVID-19 pandemic, with a slight recovery in June and July. There was a further downturn in August, before recovery in September 2020. Since then, there have been three consecutive drops across the board, with a distinct drop in December 2020, which will in part be due to the seasonal drop, regional restrictions as well as the month-long lockdown which commenced on 5th November.

New Instructions

Disease Claims

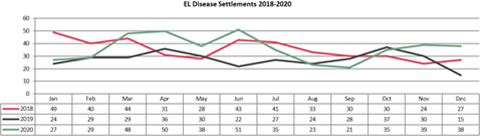

Since 2018 the number of disease notifications has fallen quarter on quarter with the quarterly averages dropping from 428 in Q4 2018 to 292 in Q4 2020. The number of new claim notifications from Q2 2020 is the lowest we have seen and represents a continued reduction in volume disease claims.

Public Liability Claims

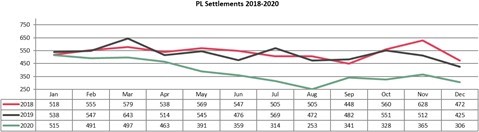

Public liability claims continue to show more fluctuation in terms of the number of cases. In similar fashion to disease we have seen the Q4 averages drop from 4,694 in Q4 2018 to 3,275 in Q4 2020. New public liability claim notifications continue to be the lowest values that we have seen.

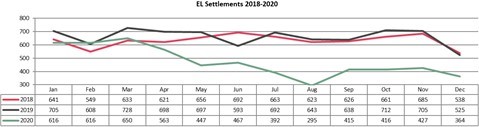

Employers Liability Claims

Employers liability claims are similar to disease as the trend in claims volumes is downward on a quarter by quarter basis. Within employers liability we have seen the final quarter averages drop from 3,639 in Q4 2018 to 2,377 in Q4 2020. The 2020 Q4 figure of 2,377 is the lowest Q4 average we have seen to date. These claims have made a steady recovery from the Q2 low of 1944 new cases, but not enough to match previous year figures. Given the continuing nationwide restrictions, we expect the trend to continue through Q1 2021, however with continued pressure on the economy and expected increase in redundancies, it is anticipated that we will see a rise in new employers’ liability claims over the next year or so.

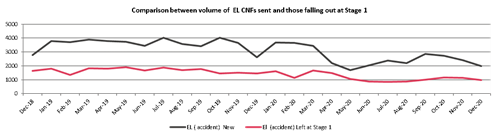

Claims dropping from the Portal at Stage 1

The percentage of employers liability (accident) cases falling out at stage 1 in December 2020 was 49.6% which is above the rolling 13 month average of 46.3%.

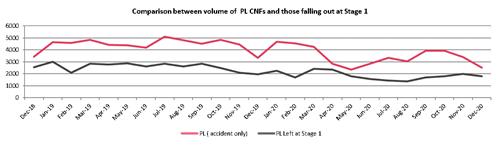

Within the public liability case type the percentage of cases leaving at stage 1 in December 2020 was 71.5%, which is well above the rolling 13 month average of 55.7%.

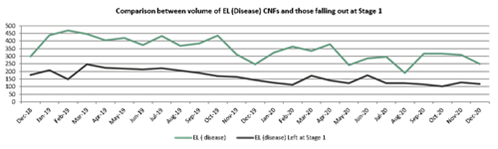

When looking at the volume of employers liability (disease) cases 47.4% fell out of the process at stage 1 in December 2020. This is well below the rolling 13 month average of 45.5%.

The first direct impact of COVID-19 at this stage was seen in May 2020 and after a secondary dip in August 2020 we have seen a similar trend as the other case types.

The difference between accident type cases and disease cases is likely to be related to the fact that investigations continued to be hampered in accident cases. Not only as a result of the regional and national restrictions but also because the furlough of staff has hampered Insurer’s ability to make a liability decision within the portal time allowance.

Portal Settlements

The general trend here is downward where the averages have reduced year on year. In 2018 the average was 632 settlements and although the annual average for 2019 actually increases slightly, to 662 settlements, the December settlements have continued to fall. The 364 settlements seen in December 2020 is the lowest we have seen since August 2020.

Settlements have continued to fall in public liability claims. Whilst there is a demonstrable seasonal drop in cases each December, the 2020 figure of 306 is the lowest December figure in the last three years and is also the lowest we have seen since August 2020.

The chart above details the employers liability disease settlements and it is clear that there is more fluctuation with this claim type, although overall, we have seen the same trend as we saw displayed by employers and public liability cases. Between 2018 and 2019 the average settlements dropped from 35 to 28. In 2020 the average is 36 and actually the 51 settlements in June was the highest we have seen since November 2017. The 38 settlements in December 2020 was a nominal drop on the last month.

Average Damages

The average damages paid across 2020 for employers liability claims was £4,663. The average damages paid in December 2020 was £4,694, just above the average, but comfortably higher than the average damages paid in previous Decembers, such as £4,271 paid in December 2019.

In respect of disease average damages, from 2017 to 2019 the average increased from £3,741 in 2017 to £4,205 last year. The 2020 year to date average was £4,078 which is not continuing the yearly trend and the December 2020 figure of £3,455 is lower than the 2020 average and the lowest seen since August 2017.

In relation to public liability claims, the average damages paid in December 2020 was £4,368 which is the lowest monthly average since February 2020, and conformably below the annual average of £4,517.

Forecasting

The general trend is for the number of new CNFs presented to continue to fall, particularly in employers liability disease claims, where volumes of noise induced hearing loss claims continue to fall.

The continued cycle of the regional and national restrictions continues to cause some volatility on both new notifications and on volume of settlements. Over the coming months, should restrictions start to ease, we would expect to see claims numbers start to increase, particularly in employers and public liability cases.

For more information or advice, please contact one of our experts in our Casualty Injury team