After a pandemic-induced pause, strong investment appetite once again abounds in the healthcare sector. As the transformation of healthcare continues, James Reed explores how this is driving M&A activity, looking at the key areas in which investors are seeking to deploy funds. On the digital health side, he asks ORCHA how to spot the truly transformative solutions, and analyses the lifecycle of one such solution, S12 Solutions.

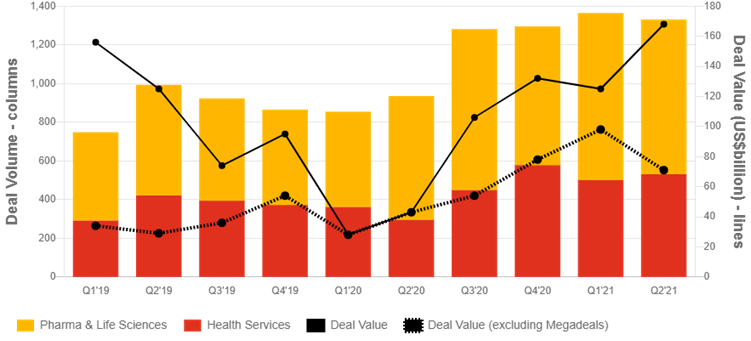

Following a peak of healthcare M&A activity in 2019 (see Figure 1), the early months of 2020 saw dealmaking volumes drop-off significantly, as the pandemic caused havoc for corporate decision-making. Uncertainty followed, and many transaction plans were put on hold as resources were focused on dealing with operational matters and putting in place measures to deal with the pandemic. This was true for dealmaking across almost all sectors. But with the return of postponed medical treatments, and an acceleration in the trend towards digital transformation, healthcare M&A activity is rebounding strongly. Add into the mix private equity firms and other investors with accumulated capital to spend, and it is clear that appetite matches opportunity.

Figure 1: M&A trends in the first half of 2021 – Global health industries deal volumes and values (Source: Refinitiv, Dealogic and PwC analysis)

As recovery continues and transformation occurs, companies will have renewed confidence to spend as a means of achieving scale and growth. The importance of healthcare has clearly been reinforced during the pandemic, while the sector’s resilience throughout economic downturn has also contributed to deal activity and valuations running high.

In terms of the sub-sectors proving popular for investors, organisations offering vaccination-related services are an obvious target, while consumer health products are in vogue due to people’s desire to take more proactive steps to protect and enhance their immune system. The ease of marketing consumer health products – for instance, supplements and vitamins – only adds to their attractiveness.

Biotech and life sciences remain a growing area, with big pharma retaining the interest and spending power to make major moves for biotech companies, while PwC’s ‘Global M&A Trends in Health Industries: 2021 Mid-Year Update’ points to the fact that wealthy individuals worldwide have been able to bolster their savings during the pandemic and that this could therefore prompt a spike in non-urgent procedures such as cosmetic surgery and laser eye treatment.

The digital health revolution

A large proportion of investor interest, particularly in the UK, is focused on the fact that healthcare business models are adapting to digital. Digital solutions that have brought efficiencies during the pandemic are set to stay, while the mental health legacy of Covid-19 means that personal health, self-care and wellbeing innovations and app technologies are required more than ever to deal with surging demand. More broadly, the popularity of healthtech organisations among the investor community is likely to remain high, as healthcare continues to focus on improving its digital capabilities as a means of delivering greater consumer choice.

Digital health – and investment in digital health – is a prime example of an area that was rapidly developing anyway, but which has been turbo-charged by the world being thrust into crisis mode.

Recent years have seen a strong upward trajectory in terms of technological development and capital flowing into the healthcare sector. But when you consider that every day since the start of the pandemic, between 30 and 40 new digital health products have come to market, it is clear that investor excitement has never been stronger. The digital health revolution is in full swing.

The size of the opportunity is huge, but there is a premium on finding quality. Quality is the ultimate mark of success. It is the key to adoption and uptake, and therefore provides the best return on investment, while changing the lives of end-users.

Innovators have clearly led the way in the technological revolution, but healthcare professionals have also played a role in the pandemic taking digital health from tentative consideration to solid investment opportunity. Experimenting with new methods and products has made clinicians more aware of, and open to embracing, the benefits of digital. This includes medical professionals themselves using technology to improve their working methods and facilitate the delivery of treatment and care, while also recommending other services or products for their patients to use.

The types of technology are extremely varied, from solutions that improve the patient-clinician relationship through more streamlined dialogue and efficient interface, to at-home app technologies that give people the power to take greater control of their own health and wellbeing. In disciplines such as mental health, this has been transformative. Swelling demand means that such solutions are not just beneficial, but necessary, if the sector is to adequately cater to patient needs.

One such transformative solution that is helping to respond to the increased mental health demand is S12 Solutions.

The story of S12 Solutions: Startup to acquisition

Founded in 2017 by Amy Manning, an Approved Mental Health Professional (AMHP) who had grown weary of the inefficiencies that plagued Mental Health Act (MHA) assessment team organisation, S12 Solutions sought to streamline support for – and better connect – AMHPs, section 12 doctors and the people they support.

Manning had seen slow paper processes drive delays and distress and, convinced that technology could help, developed a platform to bring together the right people, in the right place, at the right time. The application ensures and streamlines secure and compliant operations, automating processes to ensure quicker access to treatment while giving professionals peace of mind and more time to focus on patient care.

The company’s goal was to assess the crisis care pathway and identify where technology could remove inefficiencies so that highly skilled professionals have more time to focus on using those skills to support people being assessed.

“A patient in mental health crisis needs help now. S12 Solutions reduces avoidable delays which put pressure on the rest of the crisis care pathway, and frees up time for professionals by allowing technology to do the heavy lifting where appropriate,” says Tim Webster, Co-Founder and Operations Director. “It’s about finding the best assessing team for the person, contributing to the best outcome for that person, and reducing the likelihood that the person will quickly return to services.”

The service was born out of the fact that crucial hours and even days can be lost sourcing doctors for MHA assessments. With a number of forms then required to be filed, depending on the patient’s circumstance, more precious time passes.

“Our process takes those forms on a digital journey so the right people receive the right documents, electronically,” explains Webster.

The antiquated journey of the paper form goes via multiple individuals, so digitisation also improves the integrity and security of the data it transmits.

S12 Solutions has a link that checks the Department for Health & Social Care’s Mental Health Act Register database of section 12 approved doctors in real-time to ensure doctors have active section 12 approval. The hub is looking at how to integrate transport booking into the application’s offer and has started incorporating payment of claims for doctors, too.

Having evolved with changing health and social care needs, S12 Solutions has found its niche as the only platform providing MHA assessment team organisation, electronic statutory MHA forms, electronic claims and video calling.

“We’re a connection device and we bridge health and social care, which is in line with UK policy goals of bringing things closer together in a more integrated way,” says Webster.

S12 Solutions is now used by approximately 75% of England’s Mental Health Trusts, supporting 5,000+ AMHPs, doctors and claim processors. It was selected for both the NHS Innovation Accelerator and NHS England’s Innovation and Technology Payment programmes, which recognise and support promising emerging innovations.

This dynamic – being able to showcase real-world impact and a unique point of difference – meant the company began to attract wider investor attention. A vision of going global has inspired its connection with Canada’s VitalHub, which acquired S12 Solutions in April 2021.

With the shared goal of simplifying user experience and optimising outcomes, the organisations are looking to expand and roll-out the S12 Solutions offering in countries with similar MHA processes, such as Canada and Australia.

“The big advantage of being part of VitalHub is that we can access global markets. By combining their knowledge and resources with ours, we can expand internationally but also in our live markets,” says Webster, who highlights home-care, among others, as an area where S12 Solutions could provide a simple, effective solution by making better use of direct patient connections.

ORCHA: Helping investors and users see what good looks like

An acquisition like VitalHub’s deal for S12 Solutions would never occur if there wasn’t a sound business case and growth strategy in play. Start-up healthcare companies do not get acquired unless they provide quality solutions to improve health and care delivery.

When it comes to identifying those quality solutions, investors and users alike need to know that innovations are not only useful and usable, but also data-secure and regulation-compliant.

In healthcare, there is no shortage of standards and regulations to comply with, but this is because the stakes are so high. With the goal of ensuring the same regulatory rigour applies in the digital health market, ORCHA was established to provide access to, and encourage adoption of, trusted technologies.

The ORCHA review process, which applications must go through in order to reach healthcare professionals (and ultimately patients) via an ORCHA app library, classifies healthcare standards into four main areas which digital solutions are measured against: data privacy; data security; clinical and professional assurance; and usability and accessibility.

“The first part of the puzzle is assessing which regulations need to be applied to which digital health solutions. Some apps are low-risk while others are dealing with things where, if something goes wrong, it can result in death,” says Ashall-Payne, ORCHA’s founder and CEO. “Innovators need to know which regulations apply to them. The tricky part is that those regulations keep changing, and so too do the products.”

To solve this puzzle, ORCHA has reviewed digital health standards on a global scale and built an underpinning assessment framework. Digital solutions must satisfy all four of ORCHA’s review standards, but the key overarching element Ashall-Payne’s teams look at is impact – and, crucially, evidence to show that impact.

“You might have the most data-secure product in the world, but if it isn’t going to have an impact for anybody, what’s the point?” she asks. “Clinicians and patients want to know whether tools are going to help them.”

Depending on the risk profile established, evidence-gathering may include clinical trials and peer-to-peer reviews. This may be time-consuming but, from an investor perspective, impact is the hallmark of a transformative solution.

“When you know the impact, you can show ROI to the system,” says Ashall-Payne. “Then the system won’t go back; the genie is out of the bottle.”

New technologies have to pass muster when it comes to the manner in which they handle data. Understandably, people want to know where and how their data is being used, stored and shared. Similarly, potential investors want reassurance that data and governance protocols are in place.

Part of ORCHA’s assessment is therefore to compile the possible ‘side effects’ of any given digital solution, and provide this information to users much like the side effects of a medicine or treatment.

“This allows people to exercise personal preference. You might be happy for your data to be used in a certain way as a trade-off for using a product, but someone else may not be,” says Ashall-Payne. “We put the information into digital health libraries which are promoted to end-users so that people can see what’s out there, what’s good and what’s safe,” says Ashall-Payne. “But we also want to help innovators, so we share information to help them become compliant.”

The number of new digital health solutions coming to market shows no sign of slowing down, but investors need to be able to separate the wheat from the chaff. Healthcare transformation has changed in light of the pandemic, but even before Covid-19 and the innovation boost provided by a needs-must mentality, digital health was starting to explode.

“When I started ORCHA, there were around 30,000 digital health apps. Now there are nearly 400,000,” says Ashall-Payne. “It’s really accelerated in the last six years and there remain huge opportunities.”

These opportunities are certainly catching the eye of the investor community, and will drive continued dealmaking momentum, with digital health contributing strongly to rising deal volumes and deal values. PwC notes that across the EMEA region, an elevated level of M&A activity is being driven by healthcare services, diagnostics, and medical devices companies as the region recovers from the setback and subsequent backlog of elective medical procedures due to the pandemic. As the backlog is dealt with, and transformation continues, so too will M&A activity.