Welcome to the second instalment of the DACB Fraud Future Series, where we continue our appraisal of predictions made prior to the Whiplash Reforms, using analytics to understand what has transpired.

In this instalment we look more closely at the growth of opponent cost building behaviours. Some of the findings reveal a problematic shift in opponent behaviour, falling squarely under the law of unintended consequences; the old adage that intervention in a complex system tends to create troublesome consequences. Below, we discuss these behaviours and what can be done to mitigate them.

Injury Layering

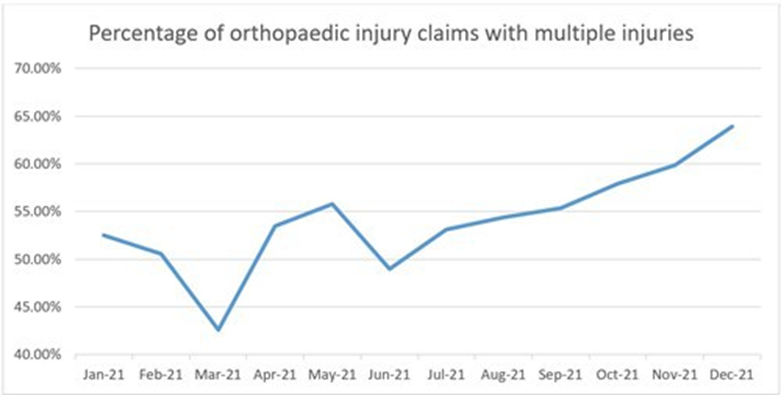

Prediction: The Whiplash Reforms will lead to an increase in claims for multiple injuries. This will reflect a bid to push claims beyond the £5000 small claims limit, and to open cost generating opportunities in additional medical examinations and treatment.

In the two years prior to the reforms, where orthopaedic injury was listed as the primary injury, approximately 50% of claims also featured at least one other injury. However, since the middle of last year, this percentage has started to rise dramatically, as shown below, reaching 63.9% for December of 2021. This could be seen as clear evidence of injury layering in the wake of the whiplash reforms.

Verdict: True – instances of claims with multiple injuries are becoming much more common.

The devil’s advocate argument here is we actually saw an under-reporting of secondary injuries in the previous MoJ Portal, because there was less focus on additional injuries and whiplash was king. The argument goes that there was little point in reporting these ‘lesser’ secondary injuries, unlike the situation now with the OIC tariffs.

This devil’s advocate argument falls down in the face of the sheer significance of the rate of multiple injuries that we are seeing. The continuing acceleration in psychological injuries, sensory injuries (such as tinnitus) and multi-site orthopaedic injuries is stark. The motive driving much of this injury layering does not originate in the tariff uplifts, or a bid to escape the track limit, but rather with the lucrative cost generating opportunities found in medical examinations and treatment. The claimant industry is currently undergoing a process of structural consolidation, with both formal and informal company arrangements allowing single groups to control various cost generating services.

The good news is that there are a myriad of strategic and tactical options available to identify and challenge these injury layering behaviours. DACB currently offer counter tinnitus and psychological injury KYO handling advice.

For more information please contact Caroline Bigos.

Prognosis Period

Prediction: We believe prognosis periods will increase significantly (in a like for like benchmarking of claims) as part of a wider bid by the claimant industry to stress test the system and escape the £5k injury limit.

The most accurate benchmarking of prognosis periods can be made on whiplash injuries, but only where the physical mechanics and severity of the collision have been recorded accurately. The below table reflects a genuine ‘like for like’ comparison of such claims, and reveals the beginning of a slight shift towards longer prognoses.

|

prognosis length

|

% of whiplash claims by |

|||

| 2019 | 2020 | 2021 | ||

|

0 to 3 months |

14.58% |

12.10% |

11.87% |

|

|

4 to 6 |

25.08% |

32.45% |

32.65% |

|

|

7 to 9 |

26.69% |

26.34% |

24.21% |

|

|

10 to 12 |

19.67% |

15.93% |

15.82% |

|

|

13 to 18 |

5.49% |

5.51% |

6.46% |

|

|

19 to 24 |

3.46% |

3.16% |

3.80% |

|

|

2 to 5 years |

2.80% |

2.91% |

2.74% |

|

|

Permanent |

2.24% | 1.60% | 2.45% | |

We anticipate that this trend will accelerate, as our figures are currently influenced by small volumes of new reports, caused by delays in the serving of medical reports in the OIC.

Verdict: Initial supportive evidence, but as yet inconclusive.

We are aware of contradictory industry analysis pointing to a reduction in prognosis periods. We would caution that this reading of the situation is flawed, due to the OIC prognosis average being dragged down by extreme short term prognoses offered on extremely minor claims. A true like for like comparison of prognoses on similar collisions, as above, shows the opposite trend emerging.

We recommend the tracking of prognosis periods by expert and claimant solicitor, to allow for ‘risk detection’ where disproportionate average prognosis periods can be identified and challenged.

For more information please contact Rob Fallows.

Our Options in Response

The first protective step is identification. Put simply, you can’t stop what you can’t see. In this sense, data is king: We need to capture the right metrics to identify injury and cost layering. This includes injury data, prognosis periods, treatment providers and medical experts, as well as all the usual detail on the incident modus operandi, cost heads and claimant solicitors.

With an appropriate dataset, it becomes straightforward to benchmark cost building behaviours. In doing so we effectively scan the market and find those enabler networks who are doing the most damage. From our initial analysis we can already see that it is networks of enablers, acting together in sequence, who are the real engines of exaggeration. Equally, the data allows quick recognition of emerging themes, such as tinnitus and PTSD enabled layering, and the company networks driving the occurrence.

The final, and most important step, is the development and application of strategies which counter the problematic theme or network. As above, DACB already have projects in place to counter tinnitus and PTSD driven cost building. Similarly, we already have full handling strategies which are bespoke to the most troublesome enabler networks. These can be deployed dynamically, and at scale, via our KYOTO system.

Later in the Fraud Future Series, we will review cost inflation in Vehicle Hire & Damage claims, looking more closely at the causes, and solutions, to inflationary pressure on vehicle recovery, storage, repair and hire.

For more information please contact Rob Fallows.