The new PIDR for England & Wales was announced yesterday as +0.5%. The new rate will be effective from 11 January 2025. The announcement can be found here.

Whilst this announcement achieves harmonisation with Scotland and Northern Ireland, a very different route has been taken to reach this point with the process in England & Wales being significantly more flexible than in those jurisdictions.

The Lord Chancellor is required to consult both the expert panel (chaired by the Government Actuary) and the Treasury as part of her decision making process. This is of course the first time that the expert panel has been part of the process. Their report to the Lord Chancellor can be found here.

The Expert Panel

The expert panel has noted that no single PIDR will be right for all claimants and decided that they should consider three core claimant types to reflect a range of key characteristics including 20 year, 40 year and 60 year claimants. The panel has calculated assumed returns for each of the core claimant groups ranging from cautious for 20 years to less cautious for 60 years and has then allowed for various assumptions against tax and expenses and also damages inflation. It has not allowed for any margin of prudence in its calculations, but this has been factored into its analysis.

The panel has moved away from a 43 year investment horizon used in the 2019 review in England & Wales and in Scotland and Northern Ireland's 2024 review by applying its three core claimant types. It does recognise that the average period is around 40 years with three quarters of claimants having a term of more than 30 years.

Tax and expenses have been calculated across the core groups and range from 1.2% for 20 years to 1.8% for 60 years. In Scotland and Northern Ireland a deduction of 1.25% was applied.

Damages inflation is indexed at CPI +1.0%, the same as applied in the previous calculation in 2019. The figure is however reached differently. The calculation takes into account price inflation (CPI) plus earnings inflation which is assumed to be in the range CPI +1.25% - CPI 1.5%. Rather than the 50/50 split applied last time, it is noted that earnings related damages are some 65 – 85% of the claimant's lump sum damages, so the outcome is pushed closer to the earnings inflation figures. In Scotland and Northern Ireland they applied Average Weekly Earnings at CPI + 1.25% in their calculation as the legislation requires that a full unadjusted index is applied.

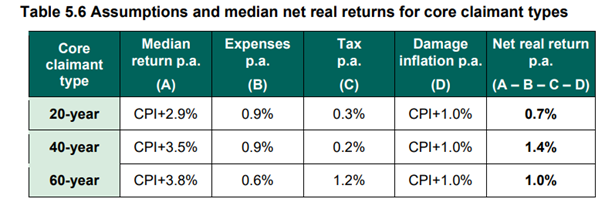

Considering the real rate of return for the three core claimant types the panel set out their calculations as follows:

The panel specifically noted that "If the PIDR were set to equal the median net real return, then there is a 50% chance that claimants will receive less than sufficient compensation (subject to all other assumptions being borne out in practice) and a 50% chance that compensation would be above that. The returns in the table above, within the range 0.7% to 1.4%, are therefore an important starting point for the Lord Chancellor’s consideration".

The panel noted that "Based on our assumptions, the analysis suggests that the existing PIDR (of -0.25%) creates a significant likelihood of over-compensation, as highlighted by the 40-year and 60-year claimants. Mitigating this risk of over-compensation would require an increase in the PIDR".

The panel tested the assumptions they had made against a range of rates and set out their key findings. In summary, a rate of +1.5% does not satisfy and a rate of +1.25% does not fully satisfy the principles against which the panel assessed the options for the PIDR. Rates in a range from +1.0% to +0.5% did meet most of the principles with different likelihoods of under- rather than over-compensation. The panel noted that "A PIDR closer to the lower end of the range of +0.5% to +0.75% is required to provide at least 50% likelihood that all of these additional claimant types receive at least sufficient compensation".

The panel also recommended that there should be a single rather than a dual rate on the basis that "the potential benefits to claimants do not currently justify the additional complexity and expense it would introduce to the claim process".

The Lord Chancellor's Decision

The Lord Chancellor appears to have taken on board and accepted much of what the expert panel has recommended. The main focus of her decision making has been the findings in the report as to the likelihood of under or over-compensation (the margin of prudence).

In making her decision, the Lord Chancellor compared the risk of under-compensation for claimants where the rate applied was +0.75% as against +0.5%.

At +0.75%, the three core claimant types would each have no more than a 30% likelihood of receiving under-compensation, however, there was only a 47% chance of the 20 year claimant receiving full compensation – which the Lord Chancellor considered to be too low.

She noted that at +0.5% all three core claimant groups would have at least a 55% chance of receiving full compensation or more, with no more than a 25% chance of significant under-compensation.

She also considered over-compensation and noted that at 0.5% there is a high prospect of over-compensation (over 40% for two of the three core groups), but considered this to be an acceptable and necessary trade-off given the risks of under-compensation at a higher rate.

The Damages Act 1996 requires the next review must start within the five year period following the last review. Today's announcement concludes this review so the next review will need to start by 2 December 2029.

DAC Beachcroft's Strategic Advisory team is well placed to work with insurers on the personal injury discount rate. If we can assist you in any way, or if you would like us to keep you informed, please contact Pete Allchorne, Joanna Folan or Michael McCabe.