The current version of the “NHS transactions guidance” (the Guidance) is now 4 years old and - in order to reflect learning from past transactions and the evolving NHS landscape - it is about to undergo a major refresh.

At the heart of the proposed changes out for consultation is a new test, which all proposed transactions falling within the scope of the Guidance will need to meet, focusing on whether the deliverable benefits the proposed transaction would bring to the population materially outweigh the costs and risks.

The proposals would also capture certain collaborative arrangements as “transactions”. This would mean that the joint appointments of CEOs, Chairs, and other senior leadership roles along with the development of committees in common with certain delegated management functions may well be subject to the requirements of the Guidance in the future. As many NHS providers seek to implement different provider collaborative models, this will be one to keep a close eye on.

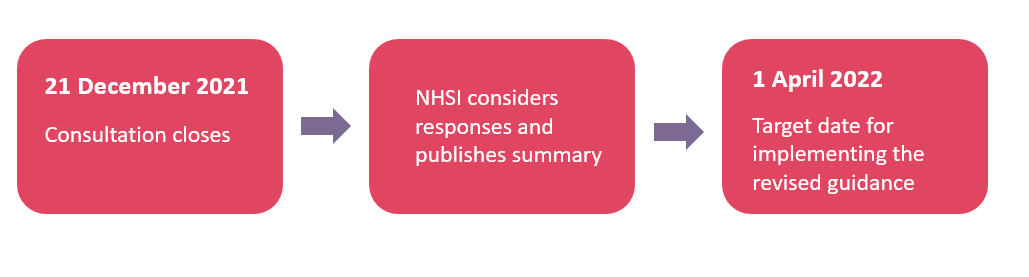

In this briefing, we summarise the proposed changes in the consultation. You have until midnight on 21 December 2021 to have your say.

Why is the transactions guidance being updated?

The Guidance governs the way that NHS England and NHS Improvement (NHSEI) assures proposed in-scope NHS transactions. Under the current version of the Guidance, this assurance generally focuses on the financial risks and benefits of the proposed transaction itself.

The Guidance is being updated to harness what has been learned over time about the drivers behind successful transactions in the sector and to reflect the move towards greater collaboration across the health and care system as a whole. There seems to be a shift in focus from the procedural identification of risk, to a more cooperative and collaborative approach of supporting Trusts to maximise their chances of success and considering wider benefits to the patient populations and the system.

What are the proposed benefits?

The consultation explains that the proposed changes should increase the chances of transactions being successful thanks to a greater focus on “critical success factors” (such as culture and staff engagement), as well as benefitting patients/the public through more emphasis on benefit identification in the planning stages of a transaction.

Other intended benefits include:

- Reducing the regulatory burden for Trusts (for example in relation to NHSEI’s financial assurance work which will focus more on incremental costs and benefits of a transaction with a more nuanced assessment of risk);

- Reducing costs for Trusts by no longer requiring them to commission accountant opinions; and

- Meeting the needs of the wider population and system by requiring Trusts involved in transactions to think about benefits and risks beyond their own boundaries.

What are the main changes being put forward?

-

Definition of a transaction

There are four proposed changes to the scope of a transaction caught by the Guidance:

- The current Guidance refers to service contracts generally but this will be narrowed down to significant service contracts which could expose a Trust or system to incremental risk (for example, the award of contracts to Trusts that would materially change the scale or scope of their activity);

- NHSEI may review novel, contentious or repercussive financing arrangements (i.e. transactions likely to cause pressure on other Trusts to take a similar approach). This would not include capital assurance processes considered elsewhere within NHSEI;

- Capital proposals for Foundation Trusts that are not in distress are taken out of the scope of the Guidance and covered by the capital regime instead; and

- Some collaborative arrangements will be brought into the scope of the Guidance where the proposed collaboration may give rise to material risk for the parties involved or be difficult to unwind in the future without significant risk. In practice, this would involve Trusts engaging with NHSEI if they have proposals for significant joint working at board level or for the development of committees in common with material delegated responsibilities.

-

New overall test for transactions

The overall test that all proposed transactions will need to meet is:

Do the deliverable benefits to the population materially outweigh the costs and risks in the medium to long term?

NHSEI will look for evidence that the proposed transaction will result in a step change improvement in quality of services for patients, including detailed advance planning of patient and population benefits. It will also assess whether the deliverable financial benefits of the transaction outweigh the costs over the medium term, and whether any risk of material short-term financial deterioration is sufficiently mitigated, as well as checking that the transaction proposals form part of an ICS strategy resulting in sustainability at system level.

-

Change in focus using new risk assessment framework

NHSEI’s assurance approach will be underpinned with a revised risk assessment framework, which will include more subjective, qualitative measures than currently. This will also involve greater focus on the areas NHSEI considers to be critical to the success of transactions, including making comparisons with good practice (to be defined in the updated Guidance) for each of these success factors, namely: culture, staff engagement, digital integration and readiness for transformational change.

It is also worth noting that:

- The guidance in relation to the creation of Trust subsidiaries is not within the scope of the Consultation (such guidance is set out in a separate addendum to the transactions guidance);

- The proposed amendments to the Guidance do not impact upon contracts covered by the Integrated Support and Assurance Process (“ISAP”), a process that still remains applicable for novel or complex contracts.

Our thoughts

The proposed new transaction tests may be difficult to demonstrate in practice, prior to implementation of the relevant transaction. For example, the proposed new overall test requires a measurement of “deliverable benefits to patients and the wider public” against the “costs and risks in the medium to long term”. This could add complexity and uncertainty for NHS providers when seeking to implement the Guidance.

There is also mention of the overall test being supported by new tests for patient and population benefits resulting from the transaction, as well as revised financial tests. This may result in a complex matrix of tests that NHS providers will need to work through, that would potentially be applicable to a wider selection of transactions, such as collaborative working arrangements between NHS bodies.

Whilst there is no doubt that factors such as “culture” and “staff engagement” are critical in any successful transaction, the measurement of such critical success factors may be difficult to articulate in an objective manner.

Whilst significant service contracts are captured under the definition of “transaction”, how will the process under the Guidance work alongside the ISAP? Is it the case that a significant service contract would either be reviewed under the Guidance or ISAP, rather than both?

Despite the potential complexity, the focus on patient and population benefits, and the need to focus on this in business cases “as standard” is a positive step and laudable in its aim. The key will be to ensure that there is a balance, whereby the intended benefits of a transaction can be stress tested in a manner proportionate to the risk that such a transaction may pose.

What next?

Should you wish to discuss the potential impact of the Consultation or any proposed response, please do not hesitate to contact us.