Sally Morris-Smith is a real estate partner at international law firm DAC Beachcroft, providing specialist legal advice for developers funders and occupiers. She considers the future evolution of final stage delivery to customers.

Logistics has become a central focus because of the rapidly shifting consumer preferences to online retail. It is reported that approximately 40 percent of total logistics costs are associated with last-mile delivery1. Location, together with a sharp eye on the finances, is key to sustainable investment2. So how is this likely to change in future? The call for increased local regulation due to public concerns around traffic congestion and environmental concerns around emissions and sustainability are certainly factors.

Another relates to the availability of space and the competition with housebuilders for sites in edge of rural locations. The pandemic has forced these issues to the forefront for many. With the number of speculative new industrial and logistics schemes coming forward, the issue can be viewed as a problem worth solving. There is no single technology, innovation or shift able to provide a singular, widely applicable last-mile solution3. Built-form, innovation, local government and technology will all have a role to play in shaping the future.

The impact of COVID-19

The pandemic has shone a light on what are, in many cases, opaque supply chains. Last-mile delivery models and the strategy, scale, risk-related dimensions and even talent needed to make them work are all being evaluated and analysed with some interesting conclusions4.

The pandemic has accelerated digitisation and increased the value of data, as well as consolidating parts of the wider logistics industry and driving swathes of retail online. It will also likely prove ‘...a catalyst for contactless, unattended and autonomous delivery technologies, putting added pressure on cities5.’

Consumer demand

Global consumer behaviour, augmented by the pandemic, is forecast to grow demand for last- mile delivery by some 78 percent by 20306. Overall an estimated 17.2 million consumers in the UK, nearly a quarter of the entire population, is forecast to permanently change the way they shop, with redirection of spending online prominent7. Ecommerce in the UK could rise from 19.2% of total retail to 33.8 % by 2024, and 53% by 20288.

Technology raises consumer expectations. For example, some 56% of global consumers already expect telecom service providers to anticipate their needs even before they know themselves9. Such expectations are likely to inform consumer behaviour in other areas, leading to consumers ‘expecting interactions with brands to be on their terms and full of personalised experiences10.’

For this reason, 64% of companies suggest they are looking to ship pre-emptively within the 2023-2025 timeframe11. Both organisational and technological barriers – often intertwined – will require strategic action if such a future is to become possible. One third of logistics players say that being ‘...able to easily exchange information with customers and suppliers is an obstacle for improving their operations,’ and around 70% suggest it will be important for their companies to become part of a logistics information sharing system by the 2023-2025 timeframe12.

Key technologies

In 2016 it was widely thought that drone and AV technology would redefine this area. And by 2026, McKinsey predicted that some 80% of last mile delivery could be carried out by a range of autonomous machines13. Despite the technological acceleration provided by the pandemic, this date now seems unlikely. For one, previous predictions appear to have been overly tech- centric, downplaying structural and regulatory issues. Thomas Zunder, from the University of Newcastle’s Future Mobility Group, notes, for example, that there is not enough air space over London to deliver every package there by air14. It is unclear and we would suggest unlikely this can be resolved in the short term, whether through technical solutions or otherwise.

Nevertheless, the global logistics and transportation drone market is now forecast to grow to

$1.6 billion in 2027, from $24.5 million in 201815. Autonomous delivery systems could eventually redraw the spatial geographies of logistics companies with access to existing transport networks potentially becoming less important. If P2P logistics take-off for last mile deliveries 24/7 operating locations near transport hubs become less important and the noise and environmental challenges for the local population are reduced. A prediction from February 2021 suggests that ‘electric aircraft such as drones could account for 30% of same-day package deliveries by 2040 as network scale dramatically brings down costs16.’

By that date, other technologies might imply a complete re-wiring of the models underpinning supply chains and last-mile. The emergence of 3D printing as a way of reducing warehousing needs (and altering last-mile) by ensuring the copy only exists in cyberspace until needed stands as perhaps the most potentially dramatic particularly for manufactured goods. The economics and footprint of last-mile could be completely rewritten as a result.

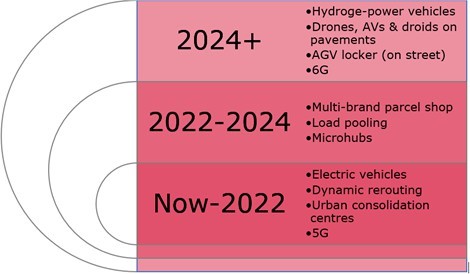

In the interim, other forms of last-mile mobility are likely to dominate. Robots that augment the carrying capacity of a human worker have been trialed, while UPS is using electric cycles and electric carts capable of holding 200kg of weight. UPS’ electrification of operations extends into its road-based models, with some 10,000 of its global fleet of 125,000 vehicles now electrified17. It is an inevitable innovation that has already been bought-into. Around 68 percent of British consumers between the ages of 18-34 believe EVs are the only cars that should be sold after 2035, while people in the 35-54 and 55+ categories, support the transition at 55 percent and 51 percent respectively18 - suggesting EVs will rapidly become table-stakes for last-mile, rather than a key source of competitive advantage. Using this technology in

combination with other possibilities – such as AGV lockers (autonomous ground vehicles with lockers) opens up more interesting possibilities. A range of technologies could impact the last- mile logistics directly, as shown below.

Figure 1: Technologies directly impacting last-mile logistics19.

With various combinations of these technologies already having identified practical solutions – such as night-time delivery, the World Economic Forum estimates 2030 could see anything from a 10% to 25 % increase in local emissions, a 15% to 30% drop in unit costs and a 25% to 30% increase in congestion20.

New models and an emerging ecosystem

Platform-based business models will connect the like-minded, entrant and adjacent-industry players. The coordination of multiple stakeholders will involve manufacturers, containers, finance, consumers, the gig-economy, transport, regulators and others. This complexity will demand a degree of flexibility and transparency that in turn fuels a market for idle assets such as transportation and storage capacity, allowing these assets to be shared and leased at ‘increasingly fine grained and coordinated intervals21.’ As a result, Frost & Sullivan predicts the last-mile market will rapidly move toward mobile freight brokerage-type22.

De-centralised and diverging last-mile delivery services will likely interface with central logistics platforms in the future, even more so when these services become autonomous in whatever guise is most appropriate.

Innovation will move to a more consumer-centric model. It is likely that by 2030, e-forwarding and crowdsourced delivery will become standard models, with startups having built complementary services to those adopted by incumbents. It is likely that some of the startups and platforms emerging now and throughout 2021 could grow from at, or near nothing to become a significant force in the space in less than a decade.

The sharing economy may provide the inspiration for such models. The World Economic Forum suggests that ecommerce growth could increase vehicles on the road some 36% by 203023. This will lead to more last-mile logistics demand as a given items journey does not end with its delivery, but also includes its collection for its onward journey. 5.3 million people in the UK already participate in the sharing economy24, and any expansion beyond car-sharing and holiday real estate will mean the capacity of ‘last mile’ delivery systems will have to scale ‘...enormously to cope with the expected volume growth25,’ and beyond.

Conclusion

In this rapidly changing environment, strategic discussions should consider.

- Data is as important as digitisation for the future of stakeholders, with the ability to act on instant insight being critical. Participation will become increasingly difficult for interested parties not delivering value through data.

- New inflows of talent will be needed as the industry shifts how it does things, and in some cases what it does, as well as who it collaborates with and the nature of competitors.

- More radical forms of innovation are likely to originate in China, for which incumbents and startups in the West should develop a radar.

- Last-mile delivery will become an omni-channel, with regional and even city-to-city preferences appearing. No single technology can possibly dominate all geographies and demographics.

- Lowering emissions, reducing city congestion and satisfying consumer demand requires greater city-logistics collaboration and an expansion beyond ad hoc technical solutions. Greater planning, better infrastructure and wider buy-into technology are all needed to find sustainable new models.

References

1 Source: MHL News, 2021 https://www.mhlnews.com/transportation-distribution/article/22054928/lastmile-delivery-models-to-revolutionize-urban-logistics-by-2025

2 Source: MHL News, 2021 https://www.mhlnews.com/transportation-distribution/article/22054928/lastmile-delivery-models-to-revolutionize-urban-logistics-by-2025

3 Source: World Economic Forum, 2020 http://www3.weforum.org/docs/WEF_Future_of_the_last_mile_ecosystem.pdf

4 Source: MMC, 2020 https://www.mmc.com/insights/publications/2020/june/differentiating-with-last-mile-delivery.html

5 Source: Automotive World, 2020 https://www.automotiveworld.com/articles/rethinking-last-mile-logistics-post-covid-19-facing-the-next-normal/

6 Source: World Economic Forum, 2020 http://www3.weforum.org/docs/WEF_Future_of_the_last_mile_ecosystem.pdf

7 Source: Essential Retail, 2020 https://www.essentialretail.com/news/uk-consumers-shift-online/

8 Source: Ecommerce News, 2019 https://ecommercenews.eu/ecommerce-uk-accounts-for-53-of-retail-sales-by-2028/

9 Source: Ericsson, 2019 https://www.ericsson.com/en/blog/2019/6/ai-in-telecom

10 Source: Tech Republic, 2020 https://www.techrepublic.com/article/why-conversational-ai-will-become-a-c-suite-priority-in-2020/?linkId=100000008988435

11 Source: Ericsson, 2020 https://www.ericsson.com/en/blog/2020/11/future-of-logistics-is-predictive

12 Source: Ericsson, retrieved 2021 https://www.ericsson.com/en/reports-and-papers/industrylab/reports/pre-emptive-logistics

13 Source: SAP Insights, 2020 https://insights.sap.com/robots-at-work-domo-arigato-partner-roboto/

14 Source: FT, 2020 https://www.ft.com/content/d9c92785-ab97-499a-97a0-5b41d233209a

15 Source: Benzinga, 2019 https://www.benzinga.com/pressreleases/19/03/b13362143/1-6-billion-drone-logistics-transportation-market-by-2027-global-analy

16 Source: Bloomberg, 2021 https://www.bloomberg.com/news/articles/2021-02-14/drones-seen-capturing-30-of-express-delivery-market-by-2040

17 Source: FT, 2020 https://www.ft.com/content/d9c92785-ab97-499a-97a0-5b41d233209a

18 Source: Energy Live News, 2020 https://www.energylivenews.com/2020/07/02/majority-of-uk-public-want-evs-to-rule-the-streets-by-2025/

19 Source: World Economic Forum, 2020 http://www3.weforum.org/docs/WEF_Future_of_the_last_mile_ecosystem.pdf

20 Source: World Economic Forum, 2020 http://www3.weforum.org/docs/WEF_Future_of_the_last_mile_ecosystem.pdf

21 Source: Harvard Business Review, 2019 https://hbr.org/2019/06/platforms-and-blockchain-will-transform-logistics

22 Source: MHL News, 2021 https://www.mhlnews.com/transportation-distribution/article/22054928/lastmile-delivery-models-to-revolutionize-urban-logistics-by-2025

23 Source: The Next Web, 2021 https://thenextweb.com/shift/2021/01/13/how-last-mile-services-and-shared-mobility-can-streamlining-the-delivery-business-syndication/

24 Source: City AM, 2020 https://www.cityam.com/the-sharing-economy-is-about-building-a-sustainable-future/

25 Source: World Economic Forum, 2015 https://www.weforum.org/agenda/2015/06/the-next-big-thing-in-the-sharing-economy/